Listing is latest new initiative aimed at modernising project delivery in Saudi Arabia

Saudi Deputy Crown Prince Mohammed bin Salman bin Abdulaziz al-Sauds stunning announcement in an interview with The Economist on 4 January that Riyadh is considering plans to list shares in state-owned oil producer Saudi Aramco will have a far reaching impact across the kingdoms economy.

While it is not yet decided how much of the company will be listed, analysts say Aramco could be worth anything from $1 trillion to upwards of $10 trillion making it the most valuable company in the world.

For comparison, the worlds largest publicly traded company, US-based technology firm Apple, had a market capitalisation of $561.4bn as markets closed on 7 January.

The initial public offering (IPO) will add much needed vigour to the kingdoms bourse, the Saudi Stock Exchange (Tadawul) and, according to the deputy crown prince, make Aramco more transparent.

New leadership

The listing will also accelerate the dramatic overhaul of the kingdoms projects sector, which began in 2015 after Mohammed bin Salman al-Saud became deputy crown prince as well as chairman of the Council for Economic and Development Affairs, and took the helm of the supreme council of Saudi Arabian Oil Company (Saudi Aramco), which was formed to replace the Supreme Council of Petroleum and Mineral Affairs.

Aramcos importance to the Saudi economy is difficult to overstate as the sale of the oil it produces accounts for 90 per cent of government income.

The state-owned oil company employs more than 61,000 workers in 77 countries, and is headquartered in Dhahran in the kingdoms oil-rich Eastern Province.

Its remit is to be a stable supplier of hydrocarbons resources, moving deeper into the value chain to produce petrochemicals products, build export refineries and advance the development of cleaner fuels. None of this will divert the worlds most valuable integrated company away from its core oil and gas business, where it remains the worlds biggest crude producer this year, with about 10.4 million barrels a day (b/d) in production.

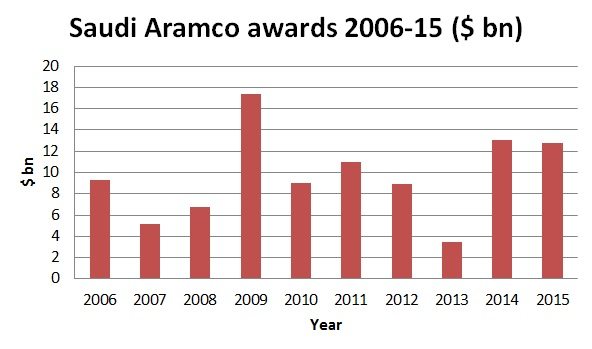

According to regional projects tracker MEED Projects, the firm and its joint ventures have awarded contracts totalling $96.9bn over the past decade, which is a yearly average of about $10bn a year.

Aramco is adapting to the downturn in oil prices. Its board has endorsed a strategic framework that will see it stay the course to pursue its 2020 strategic intent of transforming into the worlds leading integrated energy and chemicals company, allowing for short-term, tactical adjustments along the way.

The firm will maintain its project focus on sustaining production capacity of 12.5 million b/d. Its main oil field project will add 300,000 b/d to the 1.2 million-b/d Khurais field adjacent to the Ghawar oil field. The Khurais expansion, as well as the planned increase of 250,000 b/d at the Shaybah field in the Empty Quarter, will relieve pressure on other fields. In the future, unconventional gas will make a significant contribution to Aramcos plans to increase gas production.

| Key Aramco projects | ||||

| Project | Budget ($m) | Status | Award year | Due date |

| Jizan refinery IGCC power plant | 8,500 | Execution | 2014 | 2018 |

| Yanbu refinery expansion | 7,000 | Study | 2017 | 2021 |

| Arabiyah-Hasbah development: Hasbah sour gas field expansion | 3,200 | Main contract bid | 2016 | 2019 |

| Fadhili gas plant: gas central processing facility package 1 | 2,500 | Main contract bid | 2015 | 2019 |

| Ras Tanura refinery Clean Fuels Project: package 1 | 2,000 | Main contract PQ | 2016 | 2019 |

| Khurais increment programme: central processing facilities | 2,000 | Execution | 2014 | 2020 |

| Fadhili gas plant: sulphur recovery unit package 3 | 2,000 | Main contract bid | 2015 | 2019 |

| Fadhili gas plant: offsites and utilities package 2 | 2,000 | Main contract bid | 2015 | 2019 |

| Shale gas development: system C | 2,000 | Study | 2016 | 2019 |

| Ajyal residential development: 2,400 villas | 1,800 | Execution | 2015 | 2020 |

| IGCC=Integrated gasification combined-cycle; PQ=Prequalification. Source: MEED Projects | ||||

The project management company will take considerable strain away from Aramco, which in recent years has been relied upon to deliver some of the kingdoms biggest construction projects.

Sources close to Aramco have repeatedly said over recent years that these schemes have diverted the oil companys attention away from its core hydrocarbons businesses. The multibillion-dollar schemes include:

- King Abdullah University of Science & Technology (KAUST) near Jeddah

- King Abdullah Sports City development near Jeddah

- King Abdullah Petroleum Studies Research Centre (Kapsarc) in Riyadh

- King Abdulaziz Centre for Knowledge & Culture in the Eastern Province

Most recently, Aramco was tasked with delivering 11 sports stadiums, a scheme that stalled as oil prices plunged in late 2014.

To streamline its project commitments, the oil major is planning to form a new project management company with consultants that will target the SR600bn ($160bn) of government infrastructure projects planned for the kingdom over the next decade.

Project company

MEED reported in early July that Aramco had received credentials from firms and is understood to be in discussions with at least two firms. The new entity will then sell its services to other government bodies in Saudi Arabia that are developing infrastructure.

It is estimated that the potential workload of about SR600bn will require some 15,000 staff to manage.

The move by Aramco to outsource the project management of non-core projects dovetails neatly with a broader Riyadh initiative to use programme managers to contain spending.

The reason is the increasing pessimism about the possibility of any significant rise in oil prices, and the need to actively manage government spending following the announcement of the 2016 budget on 28 December.

Government officials and construction industry leaders say the majority of schemes are behind schedule, many are costing more than budgeted and completed projects are often defective. In short, the kingdom is not getting value for money from its domestic capital investment.

Video:

Impact of Saudi Aramco IPO on construction sector

New approach

The new approach is being expressed in the establishment earlier this year of a National Programme Management Office (NPMO) under the chairmanship of Saudi Arabias Economy & Planning Minister Adel al-Faqieh.

The head of the NPMO is Ali al-Zaid, a seasoned construction and real estate executive and businessman. His extensive experience includes a spell as CEO of Saudi Real Estate Company (Al-Akaria), the largest quoted real estate firm in the kingdom.

Al-Zaids task will be to develop a centre for megaproject excellence that will coordinate and, where necessary, direct radical change in the way the kingdoms public sector projects are procured and delivered.

This will entail a complete review of the construction supply chain from masterplanning through design and construction to final operation, and is designed to increase the cost-effectiveness and quality of government schemes.

If listing moves forward in 2016, these other initiatives will become even more important. By moving to make Aramco a public company, Deputy Crown Prince Mohammed bin Salman has made his strongest statement yet that the opaque inefficient methods of the past are no longer good enough.

You might also like...

Contractors win Oman Etihad Rail packages

23 April 2024

Saudi market returns to growth

23 April 2024

Middle East contract awards: March 2024

23 April 2024

Swiss developer appoints Helvetia residences contractor

23 April 2024

A MEED Subscription...

Subscribe or upgrade your current MEED.com package to support your strategic planning with the MENA region’s best source of business information. Proceed to our online shop below to find out more about the features in each package.