Exploratory drilling in Lebanese waters is expected to start at the beginning of 2019, the country’s Energy and Water Minister Cesar Abi Khalil has said.

Lebanon’s cabinet has approved a bid by a consortium of France’s Total, Italy’s Eni and Russia’s Novatek, in the country’s much-delayed first oil and gas offshore licensing round, Reuters has reported.

The exploration phase will last up to five years with a possible one-year extension, the Lebanese Petroleum Administration, the government body that manages the offshore sector, has said.

Lebanon is on the Levant Basin in the eastern Mediterranean where a number of big subsea gas fields have been discovered since 2009, including the Leviathan and Tamar fields located in Israeli waters near the disputed marine border with Lebanon. Data suggests there are oil reserves in Lebanon’s waters, but so far no exploratory drilling has taken place to estimate reserves.

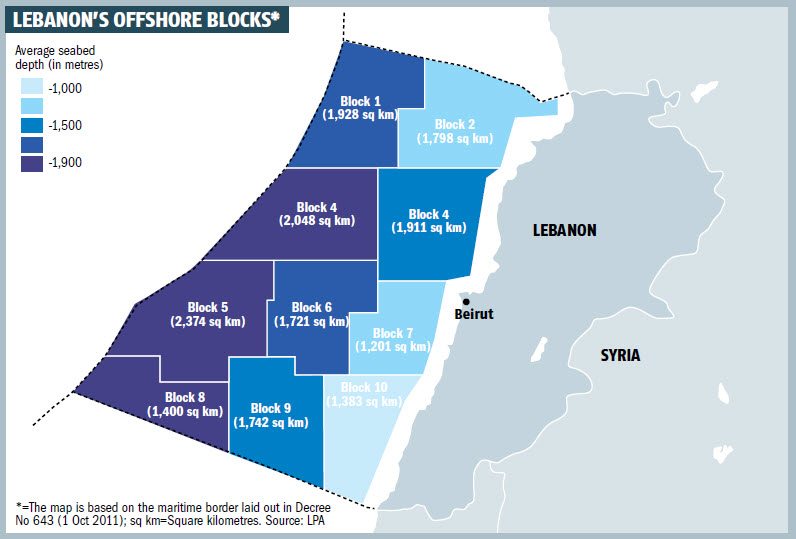

The first licensing round for exploration and production rights in five blocks (1, 4, 8, 9 and 10) was re-launched in January after a three-year delay caused by political paralysis. After being without a president for more than two years, Lebanon in January installed a new government and reactivated the licensing round.

Total-Eni-Novatek was the only consortium to submit an offer out of the 51 companies which qualified to bid, bidding for blocks 4 and 9.

Block 9 borders Israeli waters. Lebanon considers Israel an enemy state and has an unresolved maritime border dispute with it over a triangular area of sea of around 860 sq km that extends along the edge of three of the five blocks put up for tender.

The government gave no other details of the agreement with the three energy companies. But under a model exploration and production agreement published by the Lebanese government in January, companies that make a discovery must produce oil and gas for 25 years with a possible further five-year extension.

Companies must pay royalties to the state equal to 4 per cent of gas produced and a varying percentage (between 5 and 12 per cent) of any oil produced. A percentage of the oil and gas is allocated to the companies to cover their costs.

Diana Kaissy, executive director of the Lebanon Oil and Gas Initiative (LOGI), a non-governmental organisation promoting transparency and policy development in the hydrocarbon sector, said the contracts will likely be signed in January.

Kaissy said there was a legislative framework for drilling to begin, but four other draft laws for the sector were still being discussed: sovereign wealth fund legislation, an onshore petroleum law, legislation for a national oil company and a petroleum assets law.

You might also like...

Rainmaking in the world economy

19 April 2024

Oman receives Madha industrial city tender prices

19 April 2024

Neom seeks to raise funds in $1.3bn sukuk sale

19 April 2024

Saudi firm advances Neutral Zone real estate plans

19 April 2024

A MEED Subscription...

Subscribe or upgrade your current MEED.com package to support your strategic planning with the MENA region’s best source of business information. Proceed to our online shop below to find out more about the features in each package.