GCC states have adequate reserves to maintain pegs for years

The Saudi Arabian Monetary Authority (Sama)s decision to informally tell domestic banks to refrain from taking Saudi riyal to US dollar forwards contracts is indicative of the pressure that GCC currency pegs are under.

After the move, one-year dollar/riyal forwards fell to 690 points on 20 January. They had reached a record 1,020 points the previous week, according to Reuters figures.

Investors had been speculating on a devaluation.

Analysts focused on the GCC tend to think any devaluation of the Saudi riyal is extremely unlikely. The Bahraini dinar and the Omani riyal will be under more pressure, but can still avoid devaluation.

| The 5 GCC currencies pegged to the US dollar | ||

|---|---|---|

| Currency | Exchange rate to $1 | Last adjusted |

| Saudi riyal | 3.75 | 1986 |

| UAE dirham | 3.6725 | 1997 |

| Qatari riyal | 3.64 | 2001 |

| Omani riyal | 0.3845 | 1986 |

| Bahraini dinar | 0.376 | 2001 |

All the GCCs currency pegs can still be maintained in the medium-term, despite low oil prices.

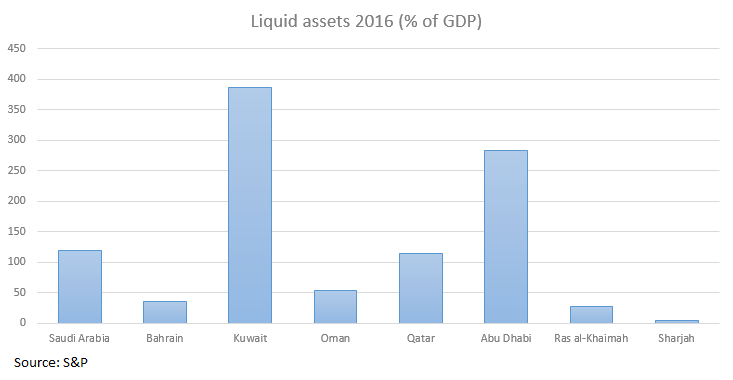

GCC currency pegs will remain in place because of the political dynamics and reserve adequacy, says Trevor Cullinan, director of sovereign ratings at US-based Standard & Poors. All of the GCC countries have at least 20 per cent reserve coverage of the monetary base, even Bahrain which has the lowest reserves.

Despite the increased risk, all five GCC countries which peg their currencies to the dollar are expected to accept faster declines in their reserves to defend the current level. None of the pegs have changed in at least 15 years, resisting pressure from high and low oil prices.

The SR393.2bn ($104.9bn) fall in Samas foreign reserves in the year ending November 2015, but it still has SR2383.3bn of reserves, or well over 100 per cent of GDP. Globally, it is in a very strong fiscal position, despite suffering in comparison to Kuwait and Qatar, which have smaller populations.

GCC reserves

Source: S&P

S&P estimates that given recently announced budget cuts and debt issuance, Saudi Arabias, Omans and Bahrains reserves will last considerably longer than the 5 years projected by the IMF.

The advantages of maintaining currency pegs are thought to vastly outweigh the cost.

The pegs are a strong monetary anchor, says Cullinan. They have served well to manage inflation and foreign currency inflows.

As the majority of exports and government revenues are hydrocarbons and priced in dollars, the pegs maintain macroeconomic stability.

This is a fundamental part of macroeconomic policy, says Cullinan. There are already substantial changes to subsidies and taxation this year so the uncertainty of an adjustment to the peg would be a step too far.

Other oil exporters which devalued in 2015 had much smaller reserves and were forced to devalue or liberalise as sharp declines in reserves left them unable to defend their currency regimes.

The Kuwaiti dinar is pegged to an undisclosed basket of currencies since 2007. The change was to avoid a simple devaluation, and is an option for other GCC countries.

GCC central banks lack many of the macroeconomic tools to manage their own currencies, due to their underdeveloped debt markets.

You might also like...

Rainmaking in the world economy

19 April 2024

Oman receives Madha industrial city tender prices

19 April 2024

Neom seeks to raise funds in $1.3bn sukuk sale

19 April 2024

Saudi firm advances Neutral Zone real estate plans

19 April 2024

A MEED Subscription...

Subscribe or upgrade your current MEED.com package to support your strategic planning with the MENA region’s best source of business information. Proceed to our online shop below to find out more about the features in each package.