Agency also assigns negative outlook to three Qatari government related entities including Qatar Petroleum

Rating agency Moodys has downgraded Dolphin Energy, the company operating the gas pipeline between Qatar and the UAE, and assigned negative outlooks to the ratings of three Qatari government-related entities (GRE) including Qatar Petroleum (QP).

The actions are related to the ongoing diplomatic dispute between Doha and the governments of Saudi Arabia, the UAE, Bahrain and Egypt.

Dolphin Energys rating was downgraded to A2 from A1 as the diplomatic divisions will erode inter-governmental cooperation between Qatar and the UAE.

Moodys forecasts that over time the weakening of relations between the two states will decrease the strategic importance of the gas import pipeline to the government of Abu Dhabi and the likelihood of support from Dolphin Energys majority owner Mubadala Development Company, which is owned by the Abu Dhabi government.

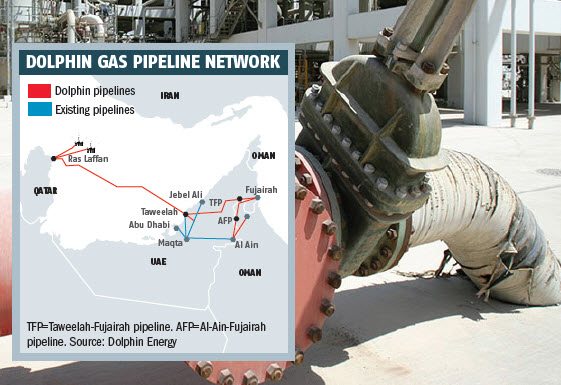

The undersea pipeline, which pumps about 2 billion cubic feet a day (cf/d) from Qatars fields to the UAE and Oman, has so far been unaffected by the diplomatic crisis since it began on 5 June.

Moodys believes that in the current geopolitical environment, if the dispute further escalates, the risk of a gas supply disruption initiated by Qatar is higher than previously assessed. The impact on Dolphin Energys debt service capacity following a supply disruption could be very severe, the ratings agency said in a statement.

Dolphin Energy is 51 per cent owned by Mubadala, with French oil major Total and US-based Occidental Petroleum company each holding a 24.5 per cent stake in the venture.

Outlook weakens for Qatar Petroleum

At the same time, Moodys has changed from stable to negative the outlook of long-term issuer ratings of QP, its subsidiary Industries Qatar (IQ), and Qatar Electricity and Water Company (QEWC).

The action is in line with the agencys recent rating action on the sovereign rating of the government of Qatar, which also changed the outlook to negative.

Moodys maintained its Aa3 long-term issuer rating on QP, Qatars national oil and gas company, which generates more than 75 per cent of the governments revenues.

While the current dispute between Qatar and other GCC-based countries, mainly the UAE and the Saudi Arabia, has resulted in some logistical challenges to the company, Moodys expects that the impact on QPs credit profile will remain limited, the agency said in a note on the three GREs.

This is driven by the limited exposure QP has to other GCC countries as the company exports the majority of its products to Asia, it added.

You might also like...

Iran-US talks see earnest engagement

27 February 2026

Kuwait receives bids for $400m Subiya utilities plant works

27 February 2026

A partner’s perspective on working with Sharakat

27 February 2026

Egypt’s Obelisk equity move merits attention

27 February 2026

A MEED Subscription...

Subscribe or upgrade your current MEED.com package to support your strategic planning with the MENA region’s best source of business information. Proceed to our online shop below to find out more about the features in each package.

Take advantage of our introductory offers below for new subscribers and purchase your access today! If you are an existing client, please reach out to your account manager.