Growth looks certain to slow down in the Saudi retail market, with declining confidence and rising costs

The Saudi retail market is one of the largest in the region, with sales worth $118bn last year, according to research firm Euromonitor International.

That makes it more than twice as large as the UAE or Moroccan markets and significantly larger than the Egyptian market too.

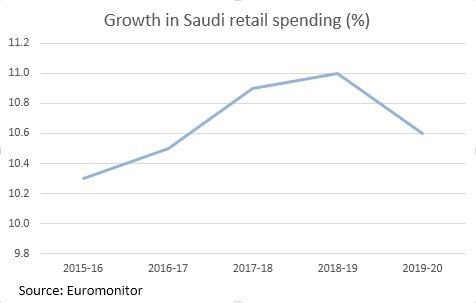

Saudi retail sales have also been growing far faster than in other large markets around the region, with a healthy 10.3 per cent growth predicted for 2015/16 by Euromonitor. However, there are plenty of clouds on the horizon and the sector could soon start to slow.

Growth in saudi retail spending

In recent years, the market has been helped by the growing population and rising disposable income, not least as a result of generous government handouts.

That has encouraged many of the larger retailers to set ambitious expansion plans. For example, fashion retailer Fawaz Abdulaziz al-Hokair Company says it will grow from 2,100 stores to 3,200 outlets by 2019.

Jarir Marketing Company, an electronics and stationary provider, plans to expand its network from 36 to 60 stores by 2018, and Saudi Company for Hardware (SACO) plans to open at least 10 new stores by 2018, taking its total to 35 outlets.

Backing family businesses

One notable characteristic of the market is that many of the countrys largest retail groups are family controlled. As well as Fawaz al-Hokair, notable family-owned businesses include the likes of Al-Bandar Trading Company and Abdullah Al-Othaim Markets Company.

Several of these are traded on the Saudi Stock Exchange (Tadawul), where they have been gaining support from investment banks.

In their most recent reports on the sector, local investment banks Al-Jazira Capital and Al-Rajhi Capital both gave an overweight recommendation for Al-Othaim Markets and Al-Jazira did the same for Fawaz al-Hokair.

The main family-owned retail players in the kingdom are quite strong, says Fatemah Sherif, a senior research analyst at Euromonitor. The key players are expected to continue to succeed with store expansion plans across supermarkets, apparel and footwear stores, and pharmacies.

| Saudi retail spending ($m) | ||||||

|---|---|---|---|---|---|---|

| Categories | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 |

| Retail sales, of which: | 118,132 | 130,266 | 143,974 | 159,683 | 177,314 | 196,064 |

| Grocery Retailers | 38,968 | 42,210 | 45,965 | 50,079 | 54,903 | 59,649 |

| Non-Grocery specialists, of which | 74,930 | 83,188 | 92,330 | 102,905 | 114,387 | 126,661 |

| Apparel & Footwear | 12,659 | 14,251 | 16,198 | 18,365 | 20,428 | 22,127 |

| Electronics & Appliances | 17,310 | 19,466 | 21,887 | 24,794 | 28,240 | 32,325 |

| Health & Beauty | 8,979 | 9,982 | 11,109 | 12,359 | 13,761 | 15,235 |

| Home & Garden | 13,720 | 14,913 | 16,017 | 17,308 | 18,526 | 19,796 |

| Leisure & Personal Goods | 20,637 | 22,895 | 25,393 | 28,312 | 31,618 | 35,318 |

| Other | 1,626 | 1,682 | 1,726 | 1,767 | 1,816 | 1,861 |

| Mixed Retailers (department stores etc) | 2,643 | 2,864 | 3,118 | 3,389 | 3,692 | 4,023 |

| Luxury Retailing | 1,697 | na | na | na | na | na |

| Non-Store Retailing* | 1,590 | 2,004 | 2,560 | 3,311 | 4,332 | 5,730 |

| *=includes direct selling, home shopping, internet, mobile, and vending machines; na=not available. Source: Euromonitor | ||||||

However, many of these local businesses could come under pressure as a result of recent reforms that will make it easier for international retailers to enter the market.

In September, the Saudi Arabian General Investment Authority (Sagia), announced that foreign investors would be allowed to own 100 per cent of some retail and wholesale businesses. Kuwaiti research firm Markaz says the decision could attract $2.7bn in investment over the next year.

Without the need to find local partners, it could also mean some family-owned retail groups start to lose market share to international rivals.

In the meantime, there are plenty of other headwinds facing Saudi retailers.

Slowed spending

Low oil prices are hurting the economy and feeding through to lower consumer confidence. Jason Tuvey, Middle East economist at London-based research firm Capital Economics, points out that ATM cash withdrawals and point-of-sale transactions slowed markedly in the second half of 2015, and growth in personal loans is at its lowest level in five years.

A number of indicators suggest that household spending in the kingdom has softened in recent months, says Tuvey. With a fiscal squeeze in the pipeline, we expect household consumption to be much weaker over the coming years than in the previous decade.

His firm is predicting consumer spending to grow at an annual rate of 2-3 per cent in the coming years, compared with 6-7 per cent over the past decade.

| Growth in Saudi retail spending (%) | |||||

|---|---|---|---|---|---|

| Categories | 2015/16 | 2016/17 | 2017/18 | 2018/19 | 2019/20 |

| Retailing | 10.3 | 10.5 | 10.9 | 11.0 | 10.6 |

| Grocery Retailers | 8.3 | 8.9 | 8.9 | 9.6 | 8.6 |

| Non-Grocery specialists, of which | 11.0 | 11.0 | 11.5 | 11.2 | 10.7 |

| Apparel & Footwear | 12.6 | 13.7 | 13.4 | 11.2 | 8.3 |

| Electronics & Appliances | 12.5 | 12.4 | 13.3 | 13.9 | 14.5 |

| Health & Beauty | 11.2 | 11.3 | 11.3 | 11.3 | 10.7 |

| Home & Garden | 8.7 | 7.4 | 8.1 | 7.0 | 6.9 |

| Leisure & Personal Goods | 10.9 | 10.9 | 11.5 | 11.7 | 11.7 |

| Other | 3.5 | 2.6 | 2.4 | 2.8 | 2.5 |

| Mixed Retailers (department stores etc) | 8.4 | 8.9 | 8.7 | 8.9 | 9.0 |

| Non-Store Retailing | 26.0 | 27.7 | 29.3 | 30.8 | 32.3 |

| Source: Euromonitor | |||||

Other factors could yet slow the market even more. Belt-tightening by the government has, among other things, included efforts to restrict public sector wage growth, cut subsidies and introduce new taxes.

Many of these issues spell trouble for retailers, in particular the introduction of a sales tax, or value-added tax (VAT), and a sin tax on cigarettes and sugary drinks. There are still many unanswered questions about these taxes, including when they will be introduced, at what rate and which goods they will be applied to. Whatever the answers, they are bound to affect sales.

Subsidy cuts

In the meantime, other state decisions are already having an impact. In its December budget, the government announced cuts to subsidies on fuel, electricity and water. Major retailers have been adding up the cost of these measures which are, in some cases, substantial.

Al-Othaim Markets says it expects its costs to rise by SR16m ($4.3m) this year. Others affected include Aldrees Petroleum & Transport Services Company, which, among other things, owns and operates coffee shops through its Super 2 Division. It says higher energy and electricity prices will mean a SR27m increase in its costs this year.

The impact on some other retailers is lower, but still significant. SACO has estimated it will take a hit of SR4-6m as a result of the changes. Saudi Automotive Services Company (Sasco), which operates petrol stations, motels, restaurants and convenience stores, said in a statement issued to the Tadawul in late December that it will also be affected, although the actual value of this impact cannot be determined at this moment.

All these rising costs will affect consumers, as will the prospect of rising interest rates, and are in turn likely to dent sales.

The increase in gasoline prices will erode disposable income, as will an increase in interest rates on credit card and personal loan debt, says James Reeve, deputy chief economist at the local Samba Financial Group.

Nor are consumers likely to benefit from any bonus salary payments this year, and for that reason alone it seems doubtful that consumption will offer much contribution to growth. There are already signs that shoppers are becoming more cost-conscious when choosing brands.

Vital advantage

The ability of different retailers to deal with rising costs and more parsimonious consumers will become clear as new trading figures are released, but the early signs are not promising. In mid-January, Jarir Marketing announced its results for 2015, which showed a 5 per cent drop in net profits in the fourth quarter compared with the same period last year.

But for all the problems they are facing, Saudi retailers continue to have one vital advantage over their peers elsewhere in the region. Cinemas are banned and there is precious little else in the way of legal entertainment in Saudi Arabia, leaving shopping as one of the few legitimate leisure pursuits available.

That alone should ensure the market remains more buoyant than in most parts of the region.

Shopping is the key entertainment form in the country, says Fatemah Sherif, a senior research analyst at Euromonitor, which is predicting growth of up to 11 per cent a year for retail sales between now and 2020.

You might also like...

Emaar appoints beachfront project contractor

25 April 2024

Acwa Power signs $356m Barka extension

25 April 2024

AD Ports secures Angola port concession agreement

25 April 2024

Abu Dhabi makes major construction investments

25 April 2024

A MEED Subscription...

Subscribe or upgrade your current MEED.com package to support your strategic planning with the MENA region’s best source of business information. Proceed to our online shop below to find out more about the features in each package.