Foreign firms can own at least 75 per cent shares in some airports

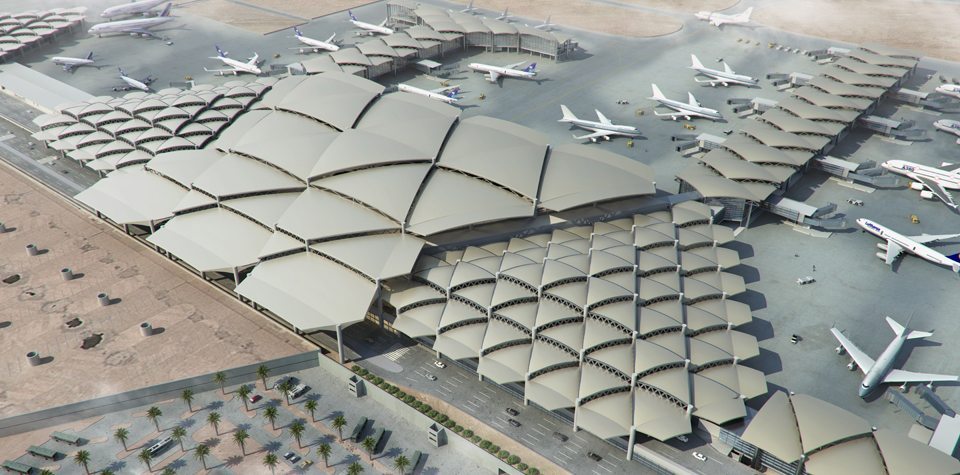

The recent selection of an Irish company to operate Terminal 5 of the King Khaled International airport (KKIA) in Riyadh kick-starts the kingdoms privatisation strategy for its airports.

All 27 airports, four of which cater to international flights, are planned to be privatised between 2016 and 2020.

Under the privatisation programme, foreign investors can buy into at least 75 per cent of some airports and they will be allowed to do so without the need for local partners. A local media report quoted Faisal al-Sugair, vice-chairman at Saudi Arabias General Authority of Civil Aviation (Gaca), saying that local investments in some airports will be capped at 25 per cent to ensure foreign operators have a majority holding in operating contracts.

The privatisation programme is understood to follow a three-step process that would include:

- Transforming the airports into an airport company

- Privatisation of the operation and maintenance sectors, which will start with Jeddahs King Abdulaziz International airport (KAIA)

- Adoption of a build, transfer and operate (BTO) strategy

The second step apparently entails transferring of employees to the investor, where Gaca will bear the capital expense to establish the project while the investor will have its share of the revenue.

The BTO model has been adopted by the Prince Mohammad bin Abdulaziz International airport in Medina, the first airport that was developed on a PPP basis in the GCC region.

The timeline for corporatising the kingdoms key airports would be:

- King Fahd International (Dammam): Third quarter 2017

- KKIA (Riyadh): First quarter 2016

- KAIA (Jeddah): Second quarter 2017

The award of a concession agreement for the operation and maintenance of Terminal 5 to the Dublin Airport Authority (DAA) precedes the privatisation of the entire airport, a local media report cited. KKIAs four existing terminals are currently undergoing a $2.9bn upgrade by a joint venture of Indias Shapoorji, Germanys Hochtief and local Nahdat al-Emaar.

The formal signing and award of the contract to DAA is expected to take place soon.

The World Bank Groups International Finance Corporation (IFC) is playing an advisory role to the KKIA privatisation programme, as well as the planned Taif International airport, which will be developed on a public-private partnership (PPP) basis.

You might also like...

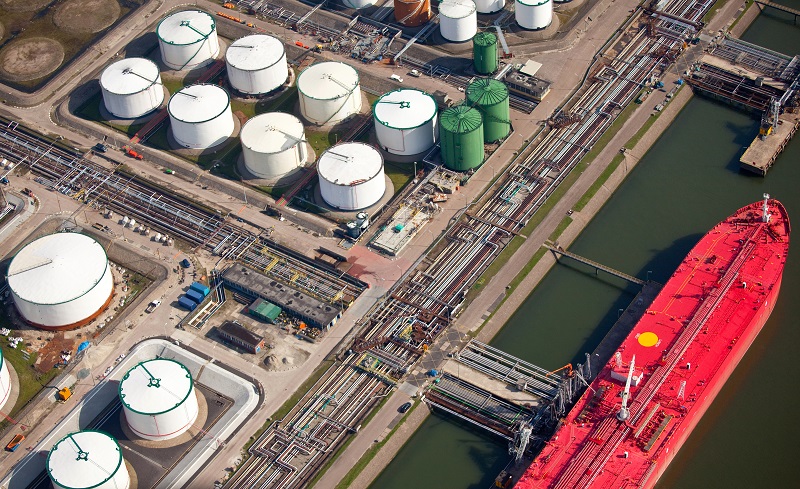

Fujairah oil facility catches fire from drone debris

03 March 2026

QatarEnergy stops downstream production operations

03 March 2026

Read the March 2026 MEED Business Review

03 March 2026

Firms prepare Port of Duqm consultancy bids

03 March 2026

A MEED Subscription...

Subscribe or upgrade your current MEED.com package to support your strategic planning with the MENA region’s best source of business information. Proceed to our online shop below to find out more about the features in each package.

Take advantage of our introductory offers below for new subscribers and purchase your access today! If you are an existing client, please reach out to your account manager.