Al-Dhafra Petroleum aims to start production at Haliba field by end of 2017

Al-Dhafra Petroleum Operations Company, a joint venture of UAE and South Korean companies, is moving ahead with the development of the Haliba oil field in Abu Dhabi, after finishing the projects design phase.

The front-end engineering and design (feed) study for the scheme was recently completed by Frances Technip, according to sources familiar with the scheme.

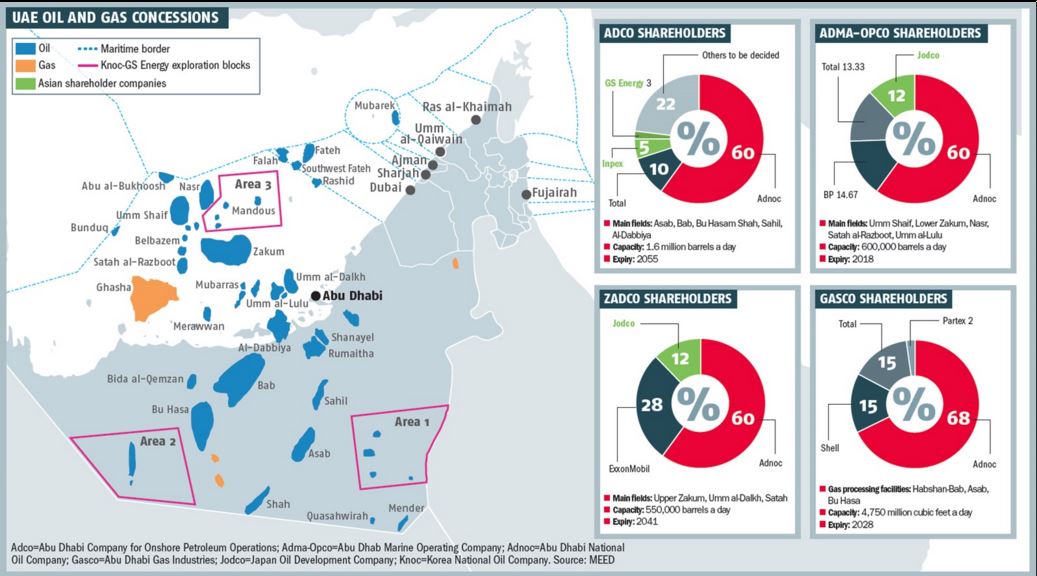

Al-Dhafra Petroleum is 60-per-cent owned by the governments Abu Dhabi National Oil Company (Adnoc), with a 40 per cent stake held by South Koreas Korea National Oil Corporation (KNOC) and GS Energy.

The 30-year deal was signed in March 2012, giving Al-Dhafra Petroleum the rights to explore three oil blocks; two onshore and one offshore. It was the first time South Korea a major customer for UAE oil took ownership of upstream assets in Abu Dhabi.

The feed study carried out by Technip is thought to cover an oil field development at Area 1 in southeast Abu Dhabi. The scheme will include bringing commercial production on stream at the Haliba field for the first time.

According to the official KNOC quarterly publication, former Adnoc director-general Abdullah al-Suwaidi led a delegation to Seoul in December 2015 to discuss the project with former KNOC CEO Suh Moon-Kyu.

Abu Dhabi delegation

[The Abu Dhabi delegation] came to Korea to discuss current issues concerning the development of the Haliba structure at UAE Area 1, where the two parties are in collaboration at the moment with the aim of initiating commercial production by the fourth quarter of 2017, the KNOC publication reported.

Al-Dhafra Petroleum made its first discovery at the Haliba field in May 2014, after its first appraisal well, Haliba-3, successfully pumped 10,000 barrels a day (b/d). This was extended later that year with 8,000 b/d from a drill test at the Haliba-4 well. The company estimated at the end of 2014 that the Haliba structure had 100 million barrels of contingent resources.

It is unclear whether Al-Dhafra Petroleum has begun the process of shortlisting engineering, procurement and construction (EPC) contractors to carry out the field development. MEED was unable to reach a spokesperson at the companys office in Abu Dhabi.

Two industry sources specialising in upstream oil projects have told MEED they are doubtful such a development will move ahead at a time of uncertainty over low oil prices. With major crude exporters currently discussing freezing production levels, Abu Dhabi is thought to be weighing up the viability of new capacity expansion schemes.

Other onshore crude projects such as Bab integrated facilities expansion and Qusahwira phase two have faced lengthy delays in the EPC phase.

Since signing the exploration deal, Knoc and GS Energy have expanded their presence in the Abu Dhabi upstream oil sector. In May 2015, the partners were awarded a 3 per cent stake in Abu Dhabi Company for Onshore Petroleum Operations (Adco) the largest crude producer in the UAE and operator of most of the emirates onshore fields.

Asian shareholder companies in UAE oil and gas concessions

Asian shareholder companies in UAE oil and gas concessions

You might also like...

Rainmaking in the world economy

19 April 2024

Oman receives Madha industrial city tender prices

19 April 2024

Neom seeks to raise funds in $1.3bn sukuk sale

19 April 2024

Saudi firm advances Neutral Zone real estate plans

19 April 2024

A MEED Subscription...

Subscribe or upgrade your current MEED.com package to support your strategic planning with the MENA region’s best source of business information. Proceed to our online shop below to find out more about the features in each package.