Germany’s Wintershall hopes to see its oil and gas production boosted by a third in the next five years with much of the growth to come from the Middle East.

Wintershall is in the midst of a merger with DEA, another German operator with assets in Algeria and Egypt, which it hopes will help make it Europe’s biggest independent oil and gas producer, CEO Mario Mehren said.

The company is targeting 800,000 barrels of oil equivalent a day (boe/d) in the next five years, up from just under 600,000 boe/d currently, Mehren said on the sidelines of the Abu Dhabi International Petroleum Exhibition & Conference on 13 November.

Wintershall signed its merger agreement with DEA in September, and is going through the approvals process with an eye on closing the deal before the middle of 2019. “Our goal is set. We want the Middle East to become a Wintershall core region,” he said.

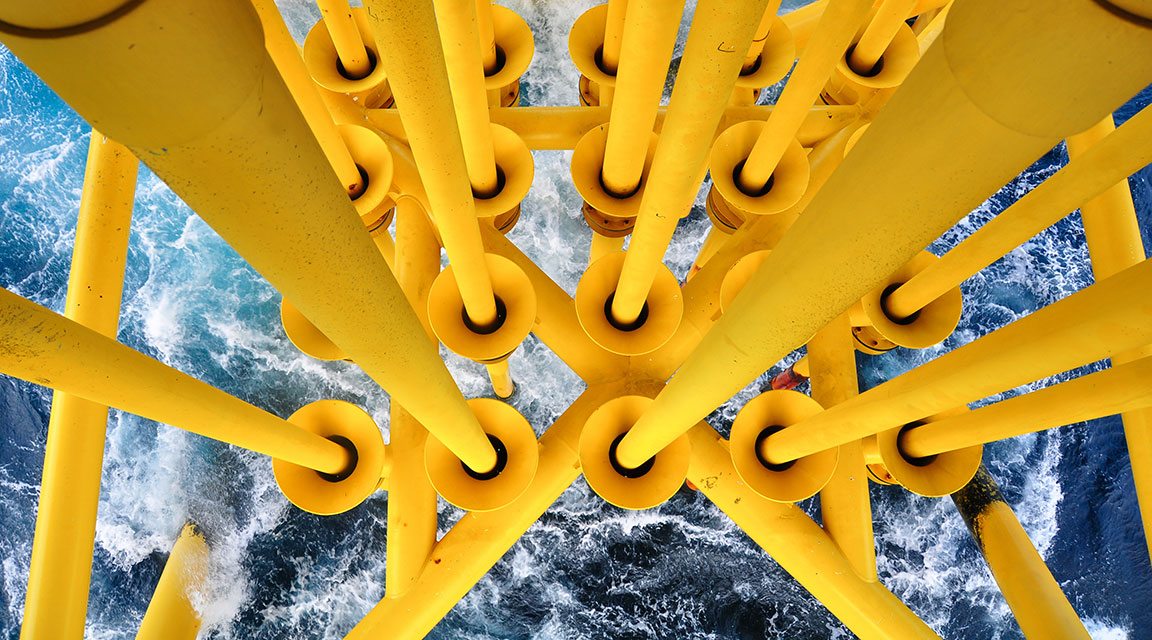

While the merger will give Wintershall access to Algeria and Egypt, the company is looking to Abu Dhabi for growth. It has drilled two appraisal wells at the Shuwaihat sour field, which lies just a few kilometres off the coast of Shuwaihat island in the Gulf. It is now in discussions with Abu Dhabi National Oil Company (Adnoc) about how to proceed with the development.

“We are talking to Adnoc about other fields. Abu Dhabi wants to be self sufficient in gas. We have more than 40 years' experience in sour gas developments, so we think we can contribute,” said Mehren.

The discussions with Adnoc cover how Shuwaihat will fit into the UAE’s larger ambitions to develop its much bigger, but also technically challenging high-sulphur gas fields, such as Hail and Ghasha. “We are working on expanding Shuwaihat to a potentially larger integrated development,” said Martin Bachmann, a board member responsible for Wintershall’s Middle East operations.

Libya limbo

Libya is another important country for Wintershall, though operations have suffered due to its security situation. Offshore operations at the Al-Jurf field, where Wintershall has a stake, along with France’s Total and state-owned National Oil Corporation (NOC), are running well. But the company’s C-96 and C-97 onshore concessions in eastern Libya are much more volatile.

“We are currently producing between 50,000 to 55,000 boe/d. I say currently, because every once in a while, you have issues, such as export terminals being closed or pipelines being unavailable,” said Mehren.

Wintershall has been locked in a dispute with NOC since the beginning of 2017 over the terms of its contract. Terms were agreed with the transitional Libyan government, without any consultation with NOC. They only reached an interim agreement in June 2017 to resume production from the concessions.

Wintershall is still in talks with NOC over a potential change in its contract to an enhanced technical service agreement. “The talks are constructive but it is not easy given the circumstances,” Mehren noted.

The C-96 concession includes the As-Sarah field, which produces around 90,000 b/d of crude, and ships from the Es-Sider and Zueitina port in eastern Libya. The field has faced numerous disruptions due to protests.

You might also like...

Iraq signs deal to develop the Akkas gas field

25 April 2024

Emaar appoints beachfront project contractor

25 April 2024

Acwa Power signs $356m Barka extension

25 April 2024

AD Ports secures Angola port concession agreement

25 April 2024

A MEED Subscription...

Subscribe or upgrade your current MEED.com package to support your strategic planning with the MENA region’s best source of business information. Proceed to our online shop below to find out more about the features in each package.