With oil prices expected to remain at about $50 a barrel in 2016, equity markets will continue to fluctuate

After a painful 2015 for equity markets, 2016 is expected to bring more of the same as oil prices continue to hover around the $50-a-barrel mark in the medium term.

Sentiment around oil prices and the effect of falling oil revenue on the wider economy will drag down GCC stock markets in 2016, as these factors did in 2015.

Outside the GCC, regional instability and underperforming economies, both in the region and globally, will continue to mute stock market performance. The best performer in 2015 was the Palestine Exchange, up 2 per cent from the beginning of the year, and Lebanons Blom Index, down just 0.7 per cent over the same period.

If oil prices were to stabilise or improve, and governments maintained spending, GCC non-oil economies would continue to grow in 2016, although at slower rates. Equity market fundamentals would see a gradual weakening, depending on the sector, reflected in the performance of indices to some extent.

IPO outlook

The expectation of continuing declines is dampening enthusiasm for initial public offerings (IPOs), which would deepen stock market offerings if they took place. However, many companies are preparing to float stock, ready for a moment of good valuations to go ahead.

There are plenty of negative sentiments going into 2016, with the only positives being the direction of regulatory reform and inclusion in global indices.

Aside from the direct effect on sentiment, oil remains the main source of government revenue. In turn, government spending is the main economic driver across the GCC, despite diversification efforts.

Oil is the key factor driving the markets, says a regional equity markets analyst. Any decline or increase will send the market in either direction. If it stays at current prices, or follows our base case scenario of around $50, so slightly higher, there wont be an impact.

Oil prices also drove market performance in 2015. In the first three quarters, GCC equity market capitalisation fell about 6 per cent to $944bn, and falls have continued since then.

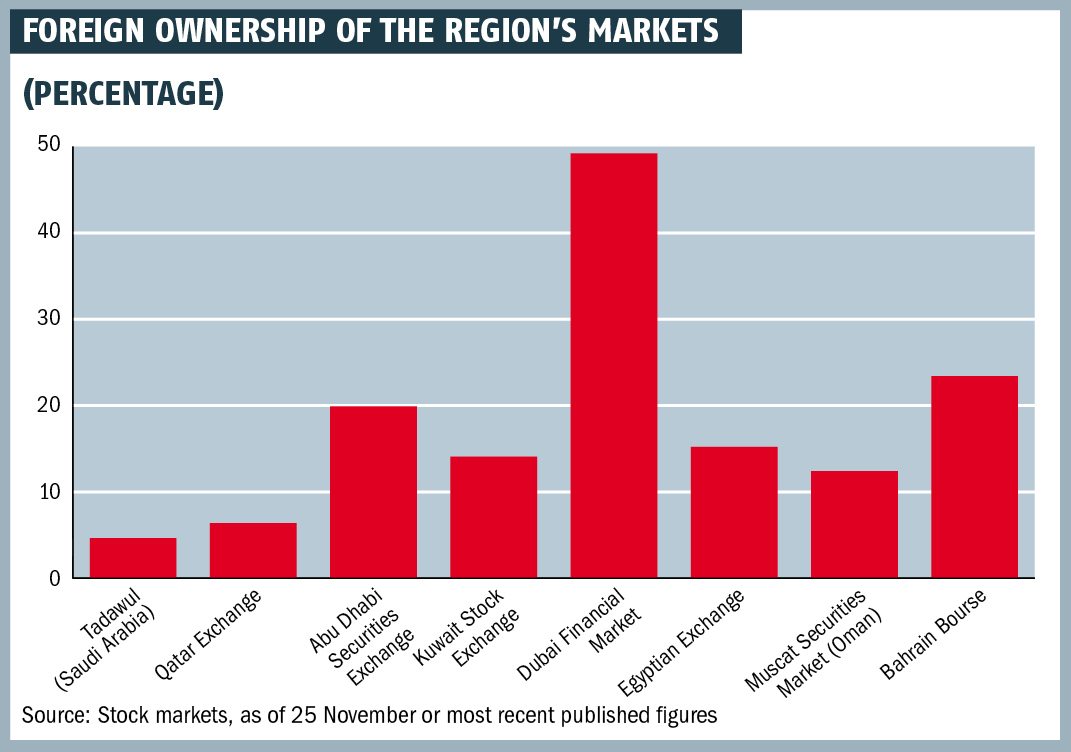

Indices have fallen significantly, with the Dubai Financial Market (DFM) the worst performer, down 14.8 per cent so far this year. Saudi Arabias Tadawul has dropped 13.5 per cent, while the Abu Dhabi Securities Exchange has held up best, although the index is still down 6.6 per cent.

Liquidity will also continue to be low, especially in smaller markets such as the Kuwait Securities Exchange. Trading volumes by value declined 29 per cent in the third quarter year-on-year there, compared with 20.1 per cent on the Tadawul in the first nine months against the same period in 2014.

Slower growth

Non-oil GDP growth will slow to 3.8 per cent in 2016, according to projections by the Washington-based IMF, weakening companies fundamentals as well as sentiment.

Weaker economic growth will directly affect the markets through sentiment, and indirectly through banks and their profit lines, says the analyst. Banks drive the market here; they are the big blue-chip companies.

Banks, which represent a major component of listed shares, will be affected by lower deposits, weaker asset quality and declining lending opportunities.

Other major sectors, such as petrochemicals, have already taken a major hit from lower prices for petroleum products globally.

Listed construction and real estate companies are expected to suffer from weaker real estate markets and slowing project spending and payments by governments. Profit reports for real estate developers continue to be high, but they are unlikely to launch new projects in the current environment, which will affect future revenue.

The UAE markets are particularly vulnerable to global trends. Slowing growth in Asia and a weak European recovery could hit the markets both through oil prices and lower trade and investment.

Kuwait saw two IPOs this year, which is unusually good, but there were still weak trading volumes

Regional equity markets analyst

Another oil shock or turbulence in global exchanges could cause GCC stock markets to tumble, as they did in August. The DFM index lost 7 per cent in a single day, while Saudi Arabias Tadawul dropped 6.9 per cent.

A sharper than expected spending cut in a GCC country could also hit stock prices. Many sectors are heavily dependent on government spending, which could affect the trade in consumer goods if public sector wages or subsidies were slashed.

Lower capital spending would hit construction and building materials firms even harder as markets slowed.

External factors

But an increase in spending in Kuwait in 2015 did not act as a catalyst on the stock market, due to external factors.

Kuwait saw two IPOs this year, which is unusually good, says the analyst. But there were still weak trading volumes. The increased capital spending might have caused the market to rebound, if things hadnt been so bad elsewhere with oil prices and the global performance of stock markets.

The poor performance is leading to depressed valuations for potential IPOs. Companies considering or preparing an IPO are delaying in hope of a better environment, or looking towards Western markets. Education and healthcare companies are perceived to achieve better valuations there.

We should see more equity offerings in Egypt, although this is closely tied to the ability to attract external funding

Steven Drake, PwC

Only Saudi Arabia and Egypt have seen significant IPO activity in the last year. Saudi Arabias decision to allow qualified foreign investors to buy shares directly boosted the Tadawul index in the first half of 2015. This encouraged a steady IPO pipeline, with three listings worth $699m between them since the beginning of the year, and a fourth, Al-Andalus Property Company, expected.

Saudi Arabia is buoyant, says Steven Drake, senior partner and head of capital markets advisory at London-based PwC. There are quite a lot of IPOs in the pipeline and it is not as sensitive to oil and global markets as the others.

The Tadawul also benefits from having more investors, appetite and diversity due to the larger scale of the economy and the exchange. However, the timing of the opening and the announcement of a potential MSCI emerging markets upgrade, over the slow summer period as oil prices continued falling, dampened the expected boost.

Egypt reforms

In Egypt, several IPOs have taken place thanks to Abdul Fattah al-Sisis programme of reforms. The largest was Emaar Misr, which raised $2.3bn in June.

Egypt has seen some activity driven by government reform and the ability of equity investors to exit in this way, says Drake. We should see more equity offerings in Egypt, although this is closely tied to the delivery of reforms and the ability to attract external funding.

The reduction in the free float requirement for companies in the UAE from 55 to 30 per cent could encourage listing, but 2015 saw a drought. The smaller exchanges also lack the liquidity to absorb too many IPOs.

The Dubai Parks & Resorts IPO in late 2014 took a lot of liquidity out of the market, says Drake. The supply is there and companies want to list, but there is no demand.

In the first three quarters of 2015, GCC equity market capitalisation fell 6 per cent to $944bn

Source: MEED

Regulatory changes, such as increasing access to foreign investors and upgrading market platforms, have facilitated inclusion on indices such as the MSCI and FTSE Russell emerging markets. While more needs to be done, market regulators are widely seen to be moving in the right direction.

This trend is bringing in more institutional investors, which tends to increase liquidity and reduce volatility.

On the Muscat Securities Market, more than 84 per cent of trades were by institutional investors, and they made up the vast majority of foreign investors in October 2015. Over the same period, the Qatar Exchange saw 42 per cent of transactions by institutional investors, predominantly foreign.

This proportion should increase when Qatar is promoted to the FTSE Russell emerging markets index. But the impact may be less than the MSCI upgrade brought.

It is not happening at a strategic time, says the analyst. Just like the opening up of the Saudi market, we probably wont see the hoped-for pick-up. Passive flows wont be significant if conditions dont change globally.

Saudi Arabia is expected to be upgraded to the MCSI emerging markets index at any point from 2017. The build-up could boost trading and prices, but weak sentiment could cancel out the effect.

Uncertain outlook

Regional instability has had a negative impact on equity markets. Following the bombing of a Russian plane over the Sinai on 31 October, the Egyptian Exchange plummeted 14.7 per cent in 19 days. Further violence would deal a blow to stock exchanges across the region.

The oil exporters will be watching governments reactions to lower hydrocarbon revenues closely. Any signs of cuts or a slowdown will make 2016 even more painful for equity market investors.

You might also like...

Iraq signs deal to develop the Akkas gas field

25 April 2024

Emaar appoints beachfront project contractor

25 April 2024

Acwa Power signs $356m Barka extension

25 April 2024

AD Ports secures Angola port concession agreement

25 April 2024

A MEED Subscription...

Subscribe or upgrade your current MEED.com package to support your strategic planning with the MENA region’s best source of business information. Proceed to our online shop below to find out more about the features in each package.